Use RSI (relative strength index) in cryptocurrency trading: Best Practices

The world of cryptocurrency trade is a high risk. With the rise of decentralized financing (Defi), Blockchain technology and cryptocurrency markets, retailers are constantly looking for new strategies to gain an advantage. The various technical indicators used in cryptocurrency is one that is particularly effective, the relative strength index (RSI). In this article we will examine how RSI can be used in cryptocurrency trade, including its best practices.

What is the relative strength index (RSI)?

The relative strength index (RSI) is an impulse indicator developed by J. Welles Wilde Jr. It measures the extent of the latest price changes to determine outdated or oversized conditions on the market. The RSI calculates two key values:

- rs (relative strength): The ratio of price change to the price range.

- RSI : A number between 0 and 100, which represents how many standard deviations are from your average value, is the current price.

The RSI is calculated using the following formula:

Rsi = (100 – average RS) / average RS

The average RS is the average of the last N period.

How to use RSI in cryptocurrency trading: Best Practices

The use of RSI in cryptocurrency trading offers several advantages, including:

- Risk management : RSI can help dealers identify overhanged or oversized conditions so that they can adapt their strategies and avoid considerable losses.

- Impulse analysis : The RSI is an impulse indicator that provides insights into the strength of the price movements.

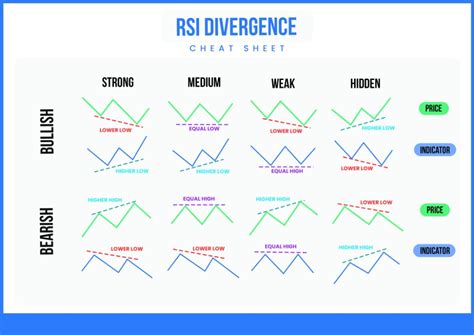

- Divergent recognition : By using RSI in connection with other indicators (e.g. Bollinger gangs), retailers can identify potential divergence between price action and market conditions.

Here are some best practices that you should take into account when using RSI in cryptocurrency trading:

Set up RSI parameters

When setting up RSI parameters, consider the following:

- Window size : Determine how many periods should be used to calculate the average RS (e.g. 14 or 21).

- Period length

: Choose a period length that compensate for the accuracy and computing power.

- overbought/oversized threshold values : Set specific overbought and oversized threshold values based on your trade strategy.

RSI values interpret

The RSI values are crucial for determining the strength of the price movements:

* OFFED (70-100) : dealers can consider taking positions that contain a risk because the market is probably overbought.

* over sale (30-69) : dealers should wait for a retreat before the market is probably oversold.

Use RSI in trade strategies

RSI can be used in various trading strategies, such as:

- Trend follows : RSI can be used to confirm the direction of trend and the entry/output levels.

- Skalping : The RSI can help dealers identify potential conversely within a short time frame (e.g. 5-minute candles).

- Range Trading : RSI can give insights into the strength of the price movements at certain area limits.

Best practice for the use of RSI

To get the best of using RSI in cryptocurrency trading:

- Use a consistent time frame : stick to a single time frame (e.g. 4-hour candlestick diagram) to analyze planning.

- Adjust the parameters and threshold values : Continuously monitor your trading output and continuously fit in the parameters and threshold values as required.

- Combine with other indicators

: Use RSI in connection with other technical indicators (e.g. Bollinger gangs, MacD) for a more comprehensive analysis.

Diploma

The relative strength index is a powerful tool that can be used in the cryptocurrency trade to identify overhanged or oversized conditions and impulse changes.